Prepaids and Initial escrow payment are recoverable funds used to pay your taxes, homeowner's insurance and interest. When the loan is paid off, escrow account balance is refunded. On refinances, the amount of prepaids and initial escrow payment is recovered soon after closing, assuming existing escrow account has no shortages, and assuming new escrow account escrows the same items.

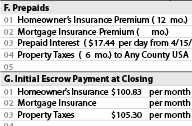

The following items need to be settled at the closing:

To calculate Prepaids and Initial escrow payment correctly, one needs to know:

Lenders are not required to provide Prepaids and Initial escrow payment amounts with any accuracy on Loan Estimates, as not all the needed data is initially available. There are, however, industry standards on how these amounts would be established for the final Closing Disclosure, when all information has been gathered. We value precision and try to calculate Prepaids and Initial escrow payment as accurately as possible on the Loan Estimate, provided we have correct information.